【Register for our Free Trial PowerUP】 Register Now

GUM App : Employee Benefits Platform

Choose topics

Key Features

1

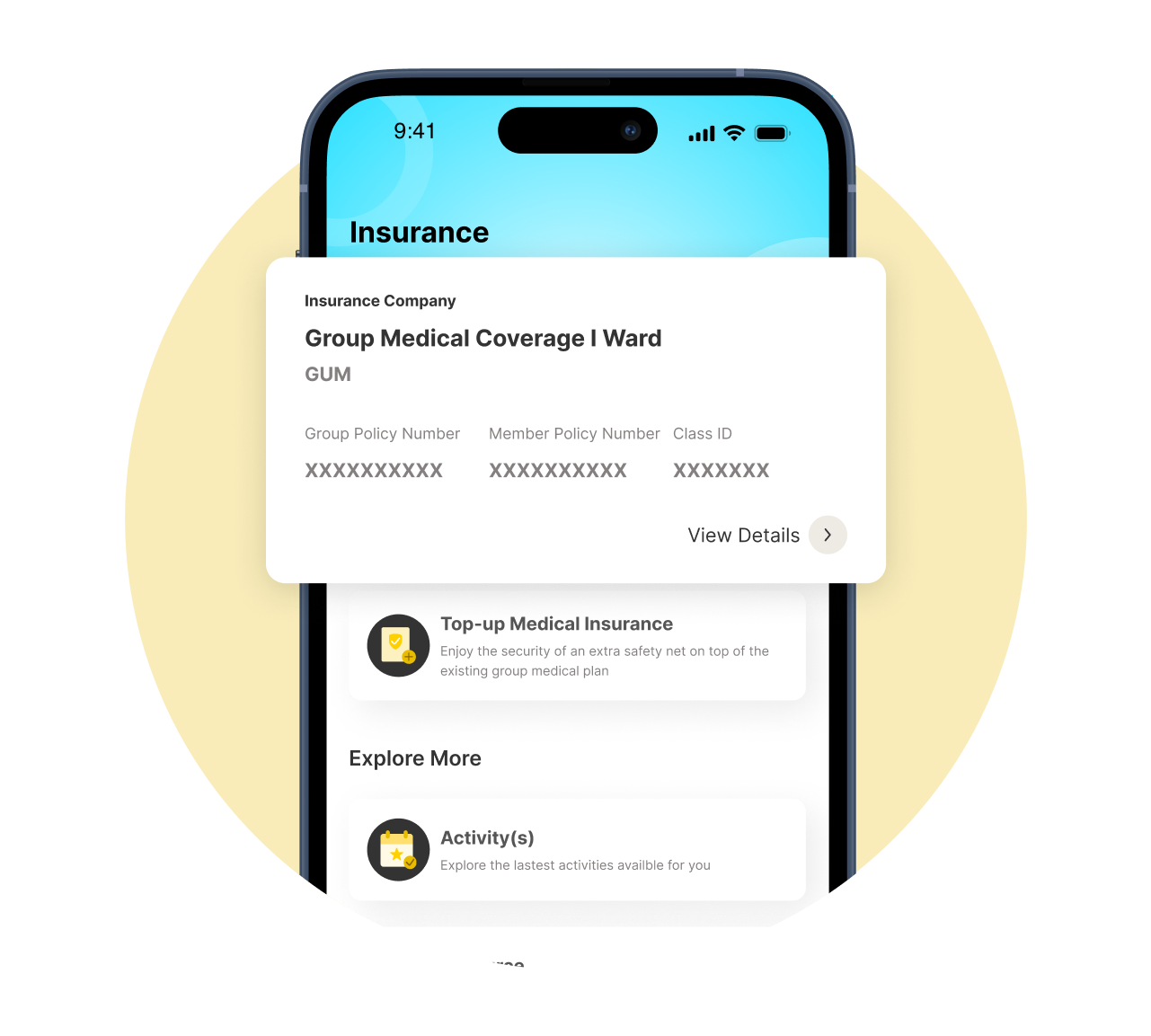

Group insurance at a glance

• View the Group Medical coverage and details in the app – similar to their group medical E-Card

• Able to download Schedule of Benefits (SOB) and the actual table on the app

• No more digging through emails/ HR portal/ different insurer app

2

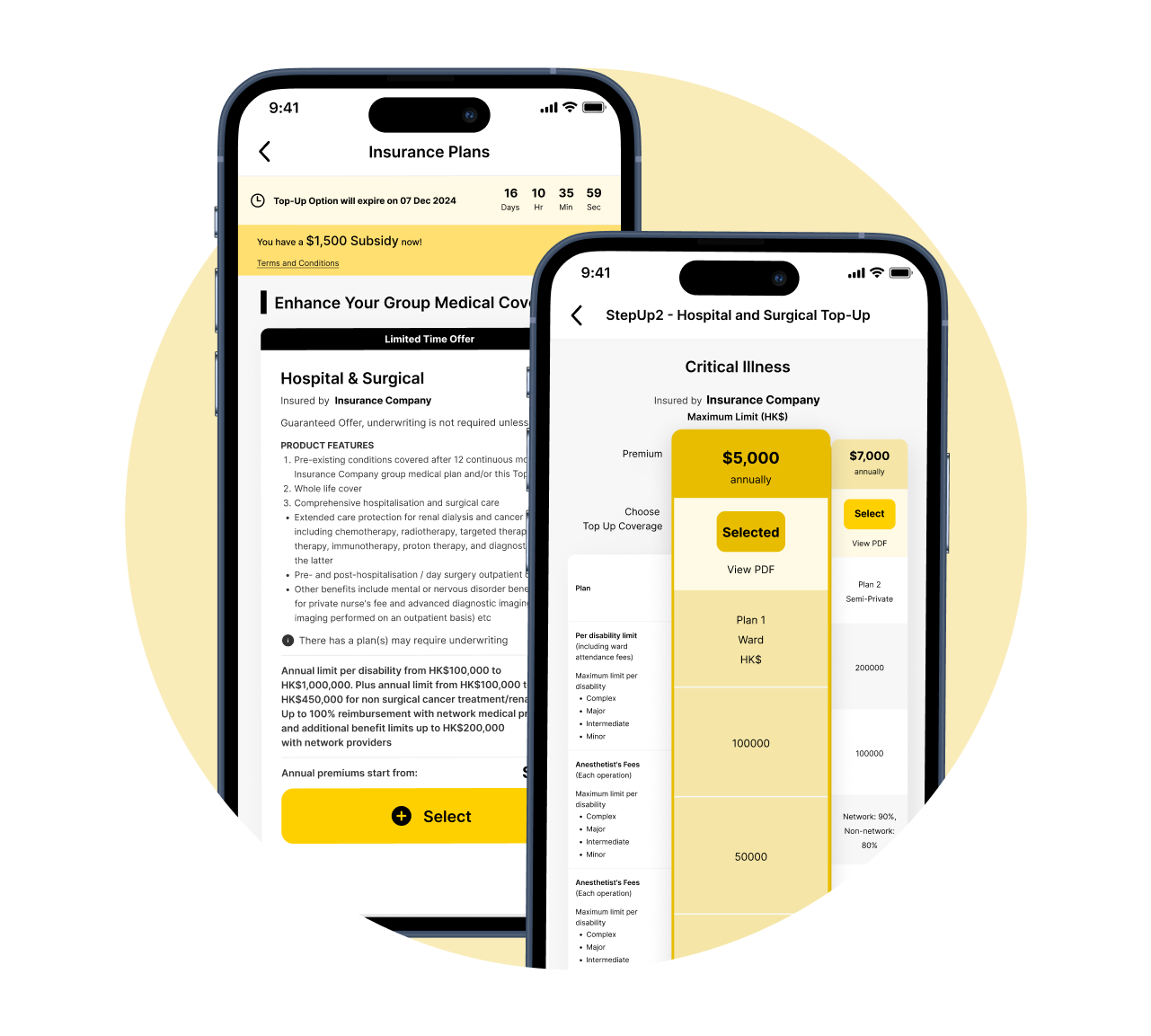

Top-up plans for employees

• All available top-up options for employees will be shown in the app

• They can choose to upgrade their protection in just a few steps

3

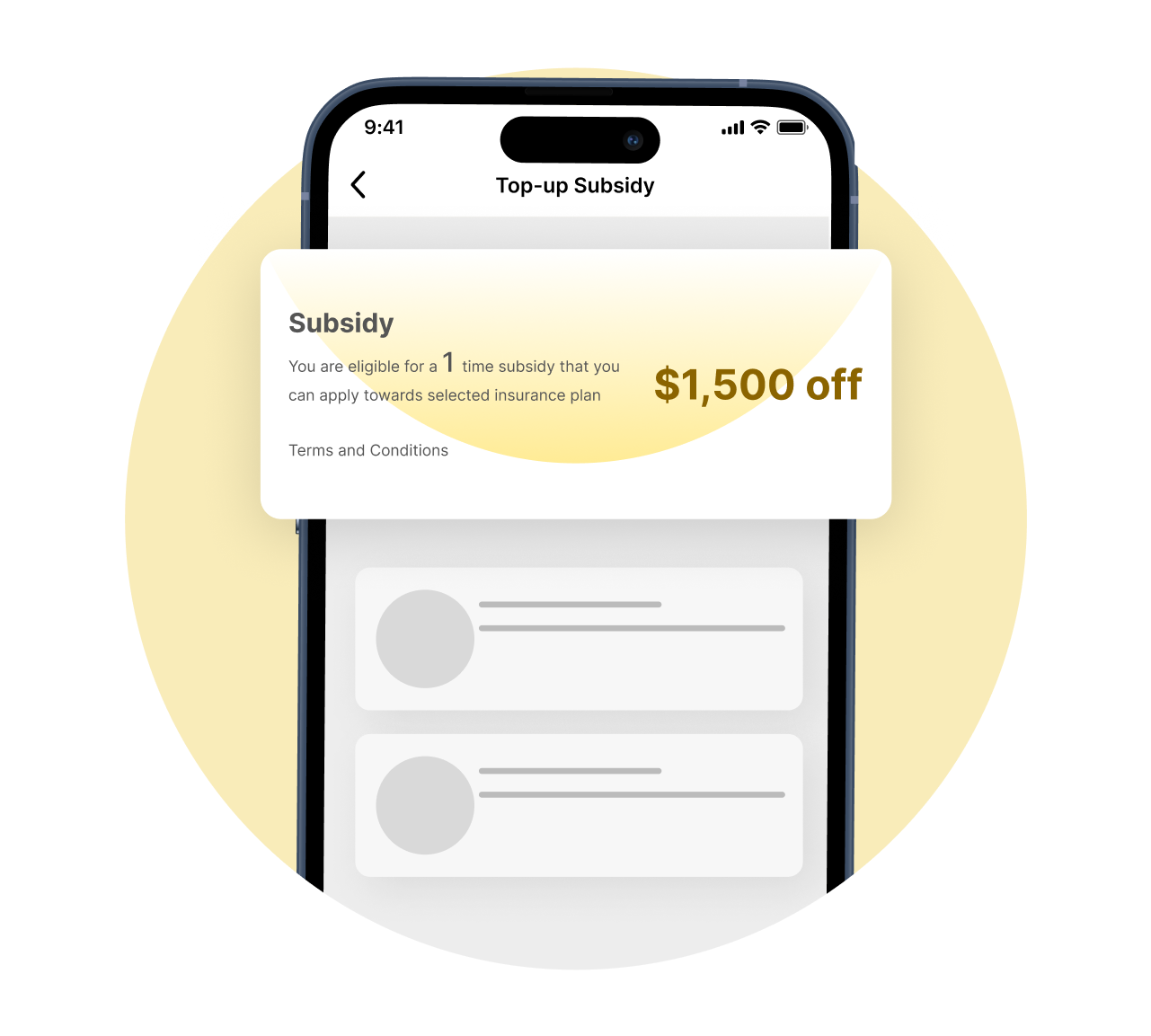

Employer subsidy for reimbursement

• The employer subsidy offer can be shown in the app

• The discount/ fixed amount can be changed based on company offering backend

• Employee can directly redeem their offer in the app

4

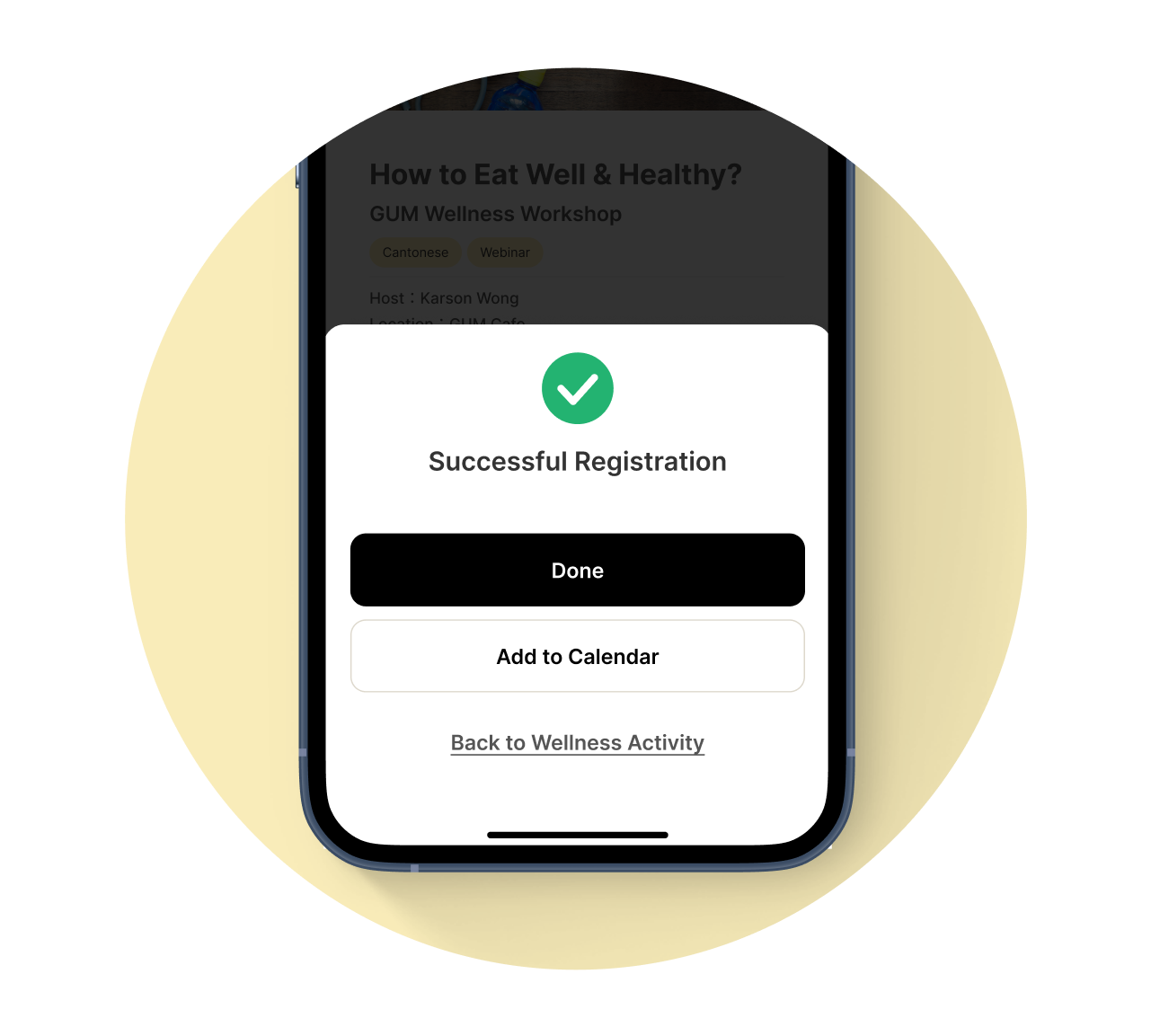

Wellness activities booking

• Employers can put their wellness activities to the platform

• Employees will receive an instant notification and make the reservation in the app

• They can also add the registered event to their mobile calendar

5

Wellness tips library

• Employees can watch our event replays and additional resources on wellness

6

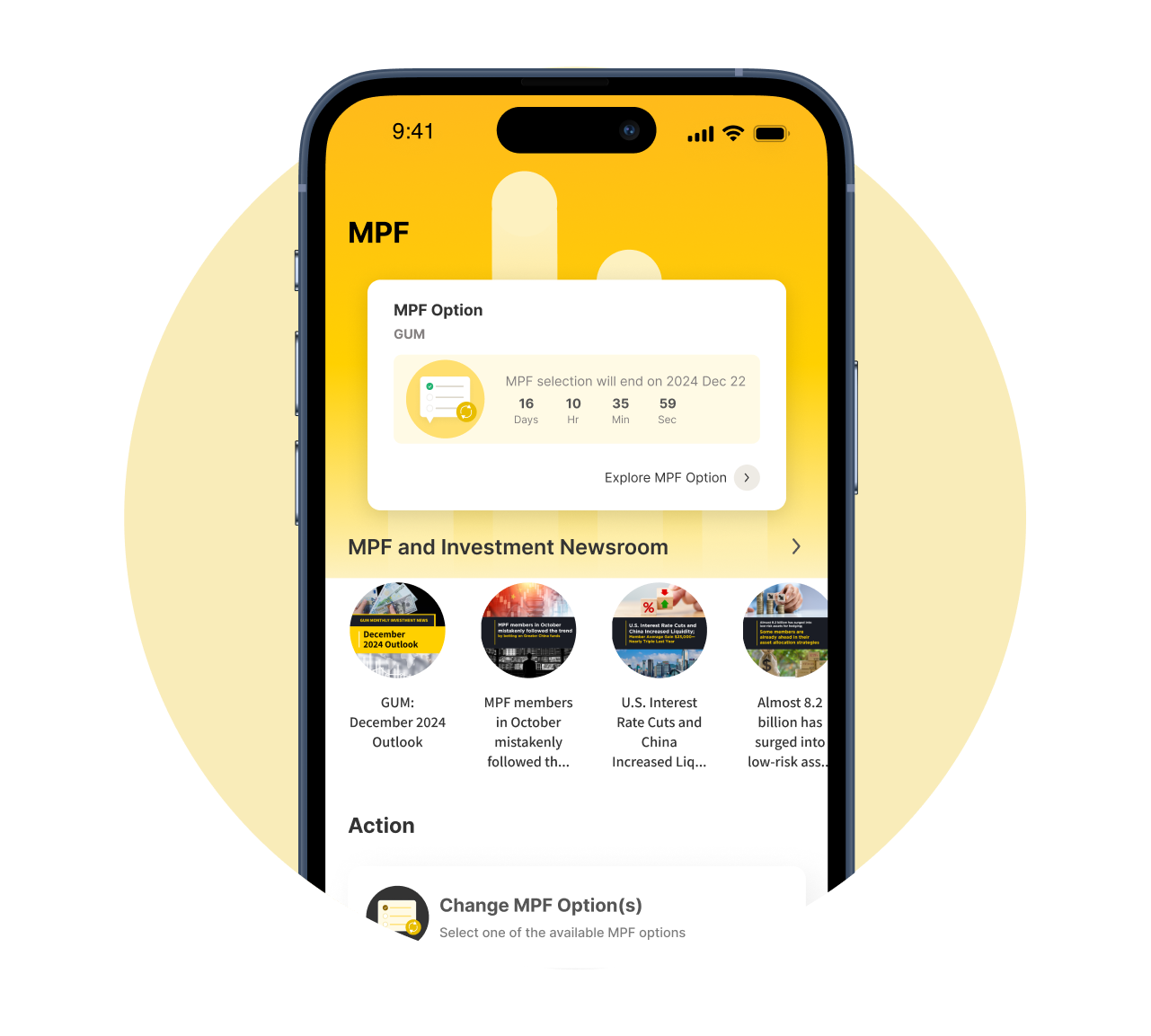

MPF Navigator

• Access the latest investment market news and tips for effective retirement management

• Allow easier MPF option choice with just a few taps

• Reach out for tailored suggestions to enhance your MPF management

7

One-to-one support

• Able to schedule the private consultation session with our experts

• Personalize service to follow up on their policy details and product introduction, etc.

Less Work, More MPF Impacts

From Members' briefings to scheme selection and ongoing support, GUM App handles it all24/7 MPF Members’ Briefings Access

Easier MPF Scheme Choice

Simple MPF Option Selection

1:1 Live Support

Proactive MPF investment insights

Additional Medical Protection for Employees

With GUM: Employee Benefits Platform, employees can not only view their existing group insurance policies and benefit coverage within the app, but they can also enhance their protection by purchasing Top-Up plans. But what are the reasons for offering Top-Up options?

Aging population

Higher utilization of healthcare services

Pressure on Public Healthcare

(i.e. longer waiting hours)

Underinsurance for Private Medical

and rely on Public healthcare

Inflation in medical cost in both Public and Private sector

(heavy demand in healthcare service)

Employers

1. Employees rely on Group Medical

2. Increase burden in providing medical coverage

3. May reduce/ cease the medical coverage

Employees

1. Fewer/ lack of Group Medical protection

2. Too old to be eligible for affordable medical insurance?

The top-up and individual medical insurance can help improve this vicious cycle.

Benefits of promoting top-up options in Group Medical

The cost of medical expenses is rising rapidly, placing a significant burden on employers and making budgeting increasingly challenging for HR. By shifting some of this responsibility to employees, employers can alleviate the burden while also offering extra protection to employees, even after they leave their current jobs. Additionally, there are benefits for both employers and employees, as illustrated below!

Benefit 1

Benefit 2

Benefit 3

Benefit 4

Enjoy the benefits of top-up plans (VS purchasing Medical insurance on their own)

No underwriting is required

Cover pre-existing conditions that are covered in group

Worldwide cover

Supports on Launching Wellness Activities

Are you struggling with low registration levels and inefficient administrative processes for wellness activities? We’re here to help!1

Comprehensive Coverage

• Focus on employees' physical, mental, and financial wellness

2

Customized Activity List

• Tailored wellness activities specific to your company’s needs

3

Real-Time Registration

• Employees can register for events instantly, with automatic limits set by HR. Registration will close once capacity is reached

4

Instant Notifications

• Employees receive immediate mobile pop-up alerts for new events

5

Event Reminders

• Automated email reminders for upcoming events

6

Calendar Integration

• Easily add events to their calendars to block off their schedules

GUM MPF IndexAboutReportGUM Workplace Health and Productivity Report 2024Employee Insurance Benefits Research 2024ORSO Survey Report 2024Quick Guide for Employers: Essentials to Know about eMPFPreparation Guide on Abolition of MPF Offsetting SP/LSP Arrangement 2024MPF Offset Abolition Insight PaperLSP/SP Offsetting Market Practice Survey ReportMPF Scheme Performance Report 2023Engaging your people with Total WellbeingGUM Top 10 Things you have to know in 2023Flexible Benefits 2023 - Trendy or the New NecessityMPF Investment Thematic Research 2023 - Higher-for-Longer Impact on MPF Investment?PowerUP Program TrialNewsroomGUM AppEventsGUM Health Forum 2025Contact UsCareers

Get Start with GUM for Business

Everything you need to know about the product and service.Copyright © 2025 GUM. All rights reserved.